Further information is available in our FICO Data Privacy Policy. When you register for our products and services, we also collect certain personal information from you for identification purposes, such as your name, address, email address, telephone number, social security number, IP address, and date of birth. PRIVACY NOTICE: When you visit this website we collect your browsing activities on our site and use that information to analyze and research improvements to the website, and to our products and services. Fair Isaac does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

Fair Isaac is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. Many factors affect your FICO Scores and the interest rates you may receive. Equifax Credit Report is a trademark of Equifax, Inc. Learn moreįICO, myFICO, Score Watch, The score lenders use, and The Score That Matters are trademarks or registered trademarks of Fair Isaac Corporation. Your lender or insurer may use a different FICO ® Score than the versions you receive from myFICO, or another type of credit score altogether. All rights reserved.Īll FICO ® Score products made available on include a FICO ® Score 8, and may include additional FICO ® Score versions. What is your average age of accounts? What are your FICO 8 and FICO 9 scores for each of the three major credit bureaus?Ĭopyright ©2001- Fair Isaac Corporation. Assuming everything else is okay you should easily qualify with DCU, Penfed, Alliant, Navy and/or BECU credit unions, and just about any other credit union you can join. What is your gross monthly income? Are you a W-2 employee? OpenRoad is a subprime lender. You should easily get approved with a credit union unless there are other problems.

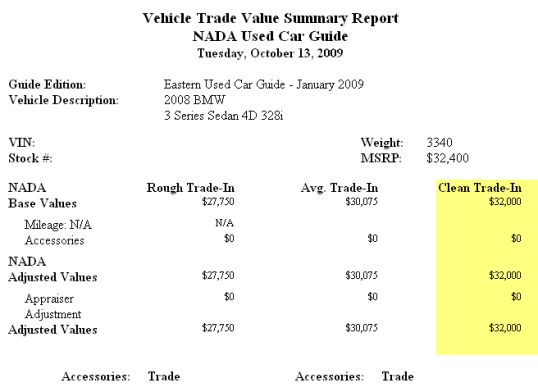

Refinancing would save me about $8K and substantially lower my payment from $325 to around $200. Here is what they send me.Īny ideas what I can do, or should I just move on. I got Prequalified through OpenRoad and tried to get the refinance loan. Refinancing would save me about $8K and substantially lower my payment from $325 to around to refinance my Bridecrest Auto Loan over 1 year with perfect payments.

Now I have these inquiries which I never would have taken if I wasnt "prequalified".Īny ideas what I can do, or should I just move on. Also, I only owe 10,300 on the car which is worth about 22K in the condition it is in and miles. I have 4 inquiries but 3 of them are due to trying to refinance this car. I have over 8 years on established accounts including rotating. Time since most recent account opening is too short.Length of time revolving accounts have been established.Length of time accounts have been established.Key factors that adversely affected your credit score: Trying to refinance my Bridecrest Auto Loan over 1 year with perfect payments.

0 kommentar(er)

0 kommentar(er)